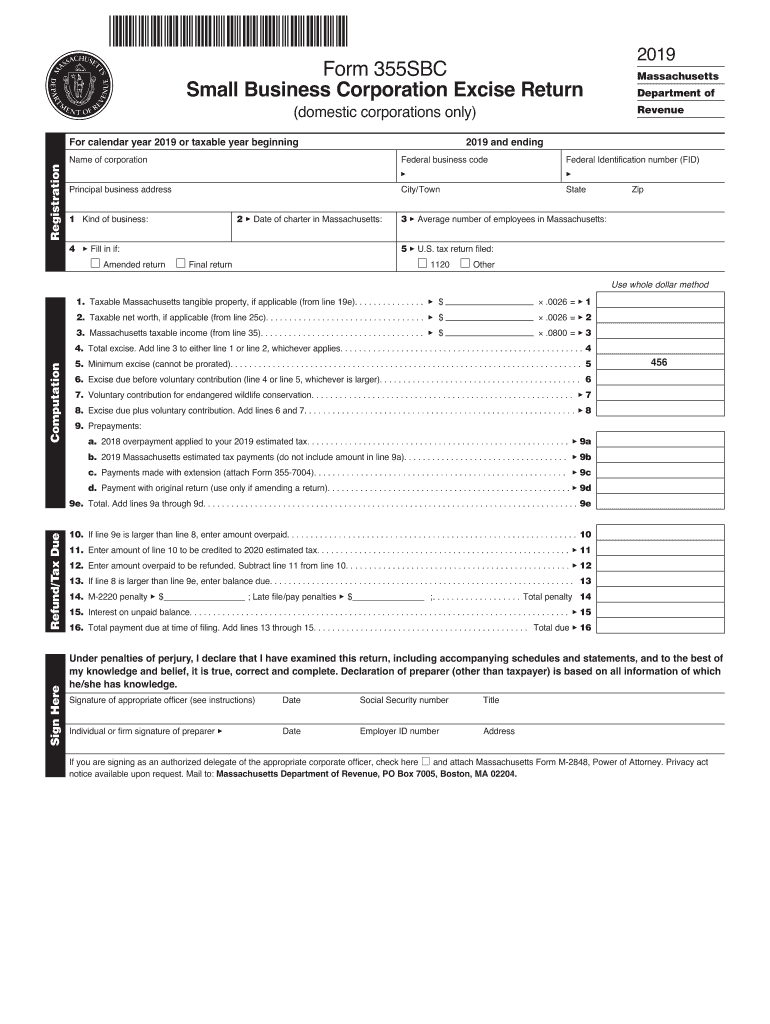

Sometimes, divorce attorneys scrutinize alleged expenses to cross-examine the person that filled out the form. For example, if you spend $100 per week on food, don’t declare that you spend $500 per week on food just to make your expenses seem larger than they are. Using estimates is okay, so long as the estimate is reasonable. It generally does not help any family law litigant to under-estimate their expenses.

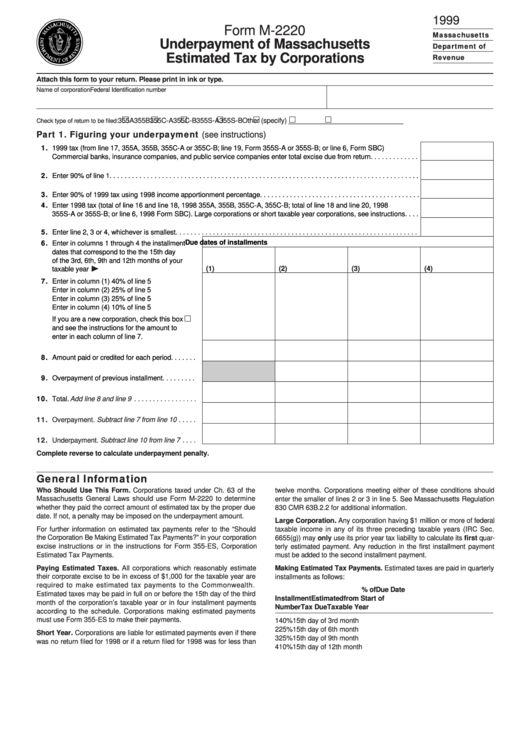

You may need to review your bills, credit card statements, and other expenses to figure this out. Try to estimate your actual weekly expenses here. Be careful that this is figure accurately represents your true income. Attach those to your Financial Statement and total them to state your total income for the previous year. Section seven: gross year income from prior yearįind your W2, 1099s, and other documents that show your previous year’s income. Section 5 allows you to include deductions that are automatically taken out of your pay for things like mandatory retirement, child support, 401k contributions, savings, etc. This section simply requires you to subtract your itemized deductions (section three) from your gross weekly receipts (section two). Multiply the amounts on your pay stub by 26, and then divide by 52 to get the weekly amount. HELPFUL TIP: If you are paid every two weeks, there are 26 pay periods each year. These deductions need to be figured out and included. If you are an hourly or salaried employee, you have taxes, FICA, and other deductions that will show on your pay stub.

MASSACHUSETTS TAP FORMS HOW TO

(Check out the helpful hint below for how to calculate weekly income). Calculate the amounts you receive so that you include the weekly total. You should make sure to disclose all forms of income that you receive from any source. This section is one of the most important sections of the Short Form.

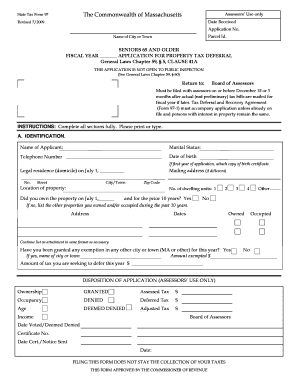

You will have to serve your financial statement on the opposing side. Keep in mind that financial statements are “impounded” in the court’s file, which means that the general public is not supposed to have access to the documents. The first section of the short form Financial Statement requires you to fill out your personal information. The entire form must be completed for each hearing that you attend. This form is used by any family law litigant that earns less than $75,000 per year in gross income. The short form consists of four pages, excluding attachments.

MASSACHUSETTS TAP FORMS DOWNLOAD

Here is a link to the Court’s website to download the Short Form Financial Statement: CLICK HERE How to complete the Short Form Financial Statement in Massachusetts The Long Form Financial Statement in Massachusetts consists of nine pages and should be filed on purple paper. The Short Form Financial Statement in Massachusetts consists of four pages and should be filed on pink paper. There are two type of Financial Statements, a short form and a long form. Financial Statementsįinancial Statements are required in all divorce cases in Massachusetts, even uncontested cases. In most cases, parties must also provide three years’ of bank and other financial account statements, tax returns, pay stubs, and so forth. In all cases, each party must complete a Financial Statement which provides a snapshot of current assets, debts, income and expenses. In all Massachusetts divorce actions, a certain level of financial disclosure is required. Guide to Financial Disclosure in Massachusetts Divorce Cases Divorce and Separate Support Actions Require Immediate Disclosures

0 kommentar(er)

0 kommentar(er)